Premium Coupon Bonds Are Less Risky

Bonds purchased at par (a dollar price of 100) are considerably more risky than premium coupon bonds for three different reasons. First, the duration is greater for a par bond. Second, the reinvestment of interest earned has less of an impact on total return. Finally, in a rising rate environment, par bonds become subject to the Market Discount Rule more quickly.

Most investors purchase bonds as a way to dampen the volatility of their whole portfolio and to create a stream of income. Since the bond portfolio is used to reduce overall risk, it makes sense to reduce the risk taken in this conservative part of the portfolio whenever possible. The purchase of premium coupon bonds is a natural way for the fixed-income portfolio manager to reduce the risk for his investors.

An Example of Bond Cash Flows

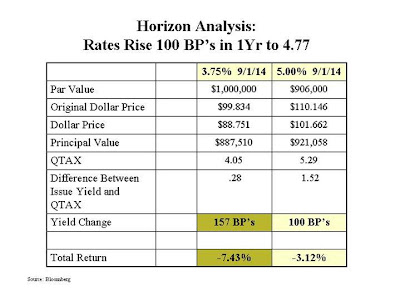

There was a Michigan Trunk muni bond issue that came the week of August 16, 2004 consisting of par bonds and premium bonds in the same maturities. The original pricing was the same for both coupon structures (3.77% yield). The par bonds were 3.75% due to mature on 9/1/14 and the premium bonds are 5.0% maturing on the same date. The following is a comparison of these two different coupon structures. Assume that about the same amount of money is invested in each bond. Both structures will provide about the same amount of total income or cash flows, if held to maturity.

The par bonds will consist of a greater par value of bonds ($1,000,000 vs. $906,000), but will have lower coupon payments than the premium bond ($375,000 vs. $453,000). The coupon payments are assumed to be reinvested at the purchase yield of 3.77%. The par bond will earn less reinvestment income than the premium bond ($73,395 vs. $91,078). Note: This illustration allows us to purchase a $906,000 block of bonds. Munis come in $5,000 denominations, but this example more accurately shows how the cash flows work.

Duration

The table shows the duration for the par bond is 8.248 at the time of issue. The duration for the 5.0% coupon is 7.927. Since the 5.0% coupon has the lower duration, it is the less risky of the two structures. Duration is a measure of market or interest rate risk. The greater the duration, the more market risk the investor is taking. Duration is similar to beta for stocks, where beta is the amount of risk the investor is taking compared to the risk of the market. One way to think of duration is as a measure of how much the price of an individual bond would change with a 1% change in interest rates. A bond with a duration of 4.0 would have a price change of about 4.0%. In our example, the par bond would change .321% more than the premium bond because of market risk (8.248-7.927).

Reinvestment of Interest Earned

The premium bond receives more cash flows from coupon payments ($453,000 vs. $375,000). The reinvestment of these cash flows creates additional interest earned for the investor. Since the cash flows received from coupon payments are greater for the premium bond, the amount of interest earned from reinvestment is also greater. In this example, we assume the reinvestment rate rises 1.0% to 4.77. This creates $4,479 in additional income for the investor in the premium bonds. This is a favorable characteristic in a rising rate environment. The investor is receiving his money back more quickly which allows him to reinvest it at higher rates (if rates rise).

Market Discount Rule

Avoiding the Market Discount Rule is the most important reason to invest in premium coupon bonds. The Market Discount Rule assigns a price (yield) for each security when it is purchased. If yields rise above that pre-assigned yield, the market would penalize the investor's security if the investor needed to sell the bond because the difference between the purchase price for the new investor and the price he receives at maturity would be taxed as ordinary income. This has a very negative impact on an individual security’s value. Most investors purchase muni bonds because they want tax-free income. Discount bonds cheaper than the market cut-off price will need to appeal to an investor willing to earn taxable ordinary income which is (in the case of the high net worth individual) most likely taxed at the maximum tax rate. Our example shows that the par bond has a market cut-off or QTAX of 4.05. If market yields were to rise to 4.77% for this maturity, the par bond would likely have to trade at a yield of 5.34% in order to entice investors to purchase the bonds. This extra yield is necessary because the difference between the purchase price of $88.751 and the price received at maturity (par or 100) is taxed at the taxpayers ordinary income tax-rate.

The premium bond would avoid this Market Discount Rule problem and would decline in value by (3.12%) vs. the decline in value of the par bond by (7.43%).

As you can see, the Market Discount Rule can have a very significant impact on total returns in a rising rate environment.

Who Buys Par Bonds?

The primary purchasers of par bonds are bank trust departments and individuals. Bank trust departments buy par bonds because of the nature of the trust relationship. In every trust, there is an income beneficiary and a remainder man. It is the trustee’s responsibility to make sure both parties are treated fairly. Tradition has argued that the best way to ensure fairness is to purchase par bonds. Remember that a bond consists of a series of cash flows. If a premium coupon bond is purchased and all of the income received is paid out, the remainder is less than what the remainder man would ordinarily be entitled to (part of the income is really amortized premium or principal). One has to question this logic, however. Is the remainder man of the trust being treated fairly if the market value of his holdings declines because of the market discount rule? One could argue that the trust department could still buy premium bonds and only pay out that portion to which the income beneficiary is entitled. This approach requires more work for the trust department, but is a lower risk strategy for the trust as a whole.

Retail investors or individuals typically purchase par bonds because they don’t understand how bonds work and they may not have the tools necessary to analyze bond cash flows properly. Bond risks are difficult to measure and not readily understood by many retail investors.

Conclusion

Risk management is a major component of managing a municipal bond portfolio. This example shows that premium coupon bonds are less risky than par bonds because they have less market risk, reinvestment risk is lower in a rising rate environment, and the risk associated with bonds becoming subject to the Market Discount Rule is greater for par bonds.

These are the reasons that most institutions and other savvy investors have been attracted to investing in premium coupon municipal bonds.

Tuesday, March 20, 2007

Muni Bonds: Why Buy Premium Coupons?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment